About Us

Our Company is Your Best Source for Value-Driven, Risk Management Solutions

Rovner & Company, LLC is a full service Insurance brokerage firm headed by Marc Rovner. We are generalists and write all lines of insurance. However, we have developed a specific niche in the real estate industry. Our team represents some of the largest privately held real estate portfolios in the country. Rovner & Company, LLC have excelled because we operate with the highest degree of integrity, as well as developed truly innovative and creative insurance solutions for our clients.

We have a number of proprietary functions that allow us maximize coverage as well reduce premiums.

Marc Rovner brings broad and diverse experience to his work. In addition to having a BS in accounting, Marc gained vast experience working as a real estate consultant at Ernst & Young Kenneth Leventhal. Marc has been in the insurance industry since 2002 and has special expertise in the real estate arena. Marc represents some of the largest private real estate owners in the country. Marc is credited with Rovner & Company, LLC’s explosive growth.

The merger of these diverse experiences creates a unique synergy that allows us to serve our client family better than others.

Why do business with Rovner & Company?

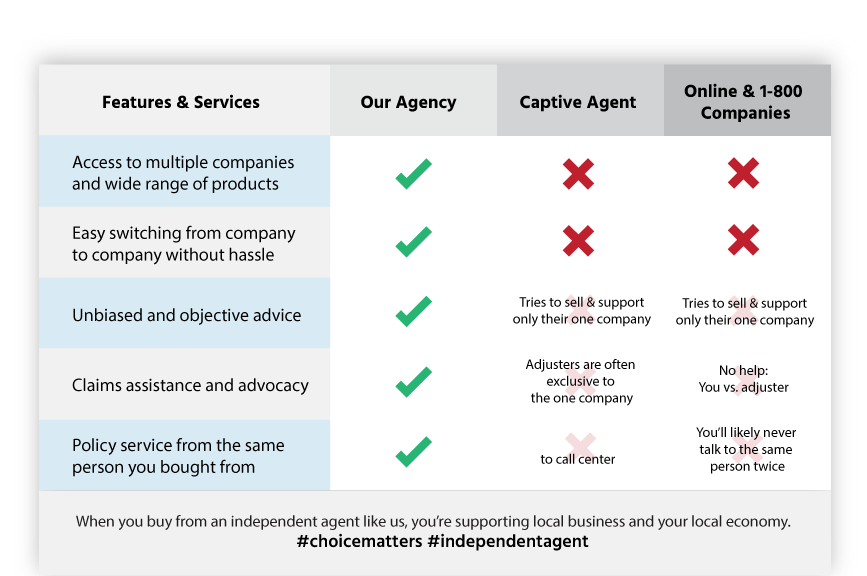

Unlike a captive, or direct insurance company who only offers their own proprietary products, our agency is 100% independent of any one company. Many insurance consumers don’t fully understand just how important that really is.

When it comes to something as important as insurance, it’s imperative that you work with an agency who has an in-depth knowledge of multiple insurance products, companies, and guidelines — not just one.

At the end of the day, what separates one agent from another, is their ability to proactively service their policy holders, and their knowledge of the insurance industry, products, and different situations that may present themselves to their clients.

Independent Agent Vs. The Rest

Here is a quick comparison of the differences between an independent agency like us, and the various other types of companies that are out there:

If you’d like to get started with a complimentary quote and/or policy review, we’d be happy to help you any way we can. Simply complete the fields below to get started online in a matter of seconds.

We appreciate the opportunity to help you, and look forward to servicing your insurance needs! Feel free to call us directly if you have more detailed questions.

More Features & Benefits

There are a lot of options when it comes to your insurance. What makes Rovner & Company, LLC the best brokerage for you? We offer services and abilities that no one else does! Our agents go above and beyond to make sure your needs are met. We pride ourselves on our RELENTLESS work ethic and we make sure that you have all the coverage you need at affordable prices!

Flexible payment options

-

- Gives you the ability to pay according to your cash flow.

- Ability to finance premiums even when the carrier does not offer installment plans.

Agents who truly care

-

- Agent will truly work as an advocate for you.

- Agent is looking to improve your situation.

Maxed out coverage for your budget

-

- We seek to cover your scenarios so that you are protected in the event of a loss.

- We seek to add coverage to maximize your protection.

- You get to sleep easy knowing that your agents have your back.

Experience of agents who have underwritten >40,000 policies

-

- You get the benefit of working with a team that has done this so often, the chances of success are increased exponentially.

- There is nothing like having the extensive experience we have. It enhances every part of the process of negotiating insurance.

Package programs

-

- We are often able to present options that allow you to bundle and save

- We do this on both Personal as well as Commercial policies.

No sales pressure analysis of current policies

-

- Free reviews and comparisons of existing policies vs. proposed policies.

- Comfortable buying environment.

Top rated carriers

-

- You get carriers that have the financial wherewithal to service a tough claim environment

- The financial rating will meet or exceed your vendor or financial institution’s requirements.

- Once you pay for the premium, you actually get coverage.

Custom tailored solutions

-

- You get a policy created specifically for your needs

- You only pay for the features YOU need, not what a captive agent is forced to sell you by their home office.

- You have the assurance that proper risk transfer takes place.

One-stop-shop for both personal & commercial insurance

-

- You only need to deal with one agent for all your needs.

- You only need to remember one phone number.

- If you need certificates, we can provide for all lines of business.

Ability to communicate the way you want including TEXTING

-

- You can contact us any time, however, you prefer to communicate.

- The text goes to our team, so if one person is out then another will respond.

Ability to have and call the CEO’s cell

-

- You have a voice that will be heard

- We care and show it by giving out Marc’s cell phone number so we can organize any issue you have.

Ability to schedule Policy Reviews with the CEO

-

- Marc makes himself personally available to any client.

- Marc will try to help you in any way he can, insurance or otherwise.

Access to CEO’s network of vendors

-

- When you transact with us, you become part of our family.

- We cross-pollinate businesses in our network and help match needs when appropriate. Over the years, millions of dollars in deals have occurred as a result.

Agents who care & want to help

-

- As a result of our culture, you get solutions because of a team really pulling for you.

- Because our team cares, they go the extra mile including staying late and pushing the limit on your behalf.

Solutions for challenging situations

-

- We hope you have easy dealings, but we excel in helping solve challenging situations.

Relentless agents scouring the marketplace for your solutions

-

- With the sticktoitiveness comes creativity.

- We don’t give up.

- We stay in the trenches with you until the problem is alleviated.

Safe Driving discounts for auto insurance

-

- We have programs that reduce your auto insurance premiums.

- We work to win your business and minimize your premium exposure.

Independent advisors

-

- We act as a broker representing YOUR interests, not those of a carrier.

- As a result, solutions are more customized to your needs.

Reciprocal business referral partnership

-

- We send business to our clients and vendors.

- We expect the same in return.

- Everyone benefits as a result.

Concierge level claims handling

-

- You ARE NOT told to call some claims phone number at the time of a loss.

- We coach you and guide you on how to best present your case.

- We report claims on your behalf.

- We recommend adjusters when we feel it’s appropriate.

Easy to do business with

-

- We make it easy to transact with us.

- Your way of doing business is our way.

Ability to get policy updates via SMS

-

- If you prefer phone calls, you get phone calls

- If you prefer texts, you get texts.

- If you prefer both, you get both.

Ability to meet with the CEO in person

-

- You get direct access to all of our resources, including Marc’s time for Commercial or Personal needs.

Ability to obtain Certificates within 2 hours or less

-

- As a business, you get paid faster.

- Pass compliance quicker.

- Satisfy your vendors and impress them.

Lender negotiation of insurance requirements

-

- If a lender’s boiler-plate requirements are over-reaching, we challenge them.

- It shields you by allowing us to be the “bad guys.”

- It often times reduces your onus, thereby reducing your premium outlay.

Loan servicer negotiation

-

- We can communicate as your advocate without involving your team.

- We are familiar with syndicated deals and can help communicate and iron out issues as they arise.

Target premium goal negotiation

-

- We have the solutions to show you what diverse coverages you can acquire with a specific budget in mind.

Reverse engineered insurance programs

-

- We can start with the goal and “backfill” the insurance solution.

- If you have an atypical scenario, we can help.

Contractor General Liability coverages with Action One Coverage

-

- You are able to present robust policies regardless of venue- even in tough environments like New York.

- You win jobs as General Contractors and Builders know you have policies that protect both of you.

- They have confidence in you that we as YOUR TEAM understand the local complexities.

Subrogated claims-loss runs removal negotiations

-

- You get an agency that follows up with carriers to remove claims that no longer need to be on your Loss Runs.

- Your Loss RESUME improves.

- Your premiums decrease as a result.

NCCI Workers Comp class code analysis

-

- We negotiate on your behalf to choose a more appropriate Workers Comp class code when relevant.

- You get an NCCI decision that you can take to your carrier upon audit.

- This has mitigated Workers Comp premiums of clients to the tune of tremendous dollars.

Marketing of Assigned Risk Workers Comp to standard markets

-

- We advocate to Standard Markets to take your business out of Assigned Risk Programs.

- As a result, you save money by not having to pay Assigned Risk Surcharges. In Florida, that can be as much as 150%.

E & S placements for tough personal lines accounts

We provide solutions for accounts with loss activity or values too high for standard markets to handle.

-

- You gain access to coverage irrespective of Value of Home or having a prior loss.

High limit umbrella policies

-

- You gain the ability to protect your nest egg.

- You get the ability to buy as much as $100,000,000 of Umbrella coverage.

New venture consulting

-

- You get the chance to discuss an approach to strategy.

- You get the opportunity to discuss Risk Mitigation.

- You get the ability to be prepared pre-launch.

An entrepreneurial company that understands your business

-

- Because we are entrepreneurs ourselves, we understand you.

- Your needs and our vision are aligned.

International “Workers Comp”

-

- If your employees travel overseas, we can craft a policy to dovetail your Workers Comp, protecting them worldwide.

- You need not to worry over domicile, understanding coverage is in place.

EPLI coverage for housekeepers and maids

-

- If you are a high net-worth client, you are at risk for an Employment Practices Liability claim.

- We get you this coverage for your maids or housekeepers.

You get to communicate in your language of choice

-

- Spanish speaking staff

- Hebrew speaking staff

Familiarity with NY and FL risks

-

- We understand the idiosyncrasies of YOUR MARKET.

- Our client base is in similar situations.

- We are best suited to meet your needs.

Familiarity with NY and FL carriers

-

- We work DIRECTLY with the insurance companies servicing your needs.

- You benefit from our access and market relationships.

National reach via ISU network

-

- On a macro level, our company is part of ISU which is licensed nationwide.

- Therefore, we can handle any scenario you have across the nation.

Ability to negotiate with London Underwriters

-

- We are able to underwrite unique risks that “regular” markets will not accept.

- We are able to offer solutions that retail agents do not have access to.

Ability to accept deposits via ACH and credit cards

-

- This allows you to transact and pay in real time, speeding up binding on your behalf.

- It eliminates the need to mail in a check.

- It allows you to focus on YOUR main thing.

Experience working with celebrities and agents

-

- We understand your complexities.

- We are adept at communicating with your team.

- We understand your lifestyle and have a service team to accommodate your unique requests.

Experience working with everyday, hard-working people

-

- We are grounded and enjoy helping every customer improve their situation.

Diverse ethnicity of our staff

-

- You get different viewpoints representing you.

- You get different attitudes advancing your needs.

- You get the greatest chance of success as a result.

An agent with an Accounting background

-

- You get an analysis of your situation with a deep understanding of your numbers.

- We understand how those numbers impact you and seek to mitigate the effects of premiums.

An agent with a Real Estate background

-

- You get Accounting, Real Estate, and Entrepreneurial expertise at the highest level helping you in those areas.

Agent and staff who train every day to up our game

-

- You get continually improving service.

- A culture of growth and enhancement.

Ability to control and schedule your interactions with our agency

-

- Ability to view our schedule and block out meetings that accommodate your schedule.

- Your schedule is primary.

An advocate and risk manager

-

- You are not alone in making buying decisions.

- We coach you.

- We work on your behalf.

A promoter of your business

-

-

- We promote your services to our other clients.

- You are partnered with us.

-

Employees available in FL, NY, and NJ to visit you. Marc will fly to you.

-

- We have staff ready, willing, and able to meet with you in person.

- You get the white glove service you deserve.

Strict confidentiality on assets and business dealings

-

- You can rest assured your information is safe.

- You can rest assured we take our fiduciary responsibility seriously.

Ability to discuss theoretical scenarios and repercussions prior to committing

-

- You can strategically plan for scenarios.

- You can discuss options without prejudice.

- You can be prepared.

Loss mitigation advice

-

- You can figure out how to reduce exposure, cost, and risk.

Carrier recommendation advice

-

- We hand-hold you during mandatory recommendation scenarios

- We help you achieve the desired results at the lowest cost possible.

Experience dealing with aluminum wiring

-

- We navigate carriers based upon the wiring exposure.

- Obtain policies without aluminum wiring exclusions.

Navigating carriers that will accept aluminum wiring

-

- We present you to carriers that can allow aluminum wirings.

Experience period analysis

-

- If you have a loss outside of Experience Period, we negotiate to have it removed from Loss Consideration.

- You present your best foot forward.

Experience period recommendations

-

- We advise you which carriers look at what experience periods.

- You gain the ability to take a snipers approach to the marketing of your insurance.

Vendor limit negotiation

-

- You get to buy the lower limits and still satisfy your vendors.

- You only pay for the insurance you really need.

Access to premier private flood markets

-

- You leverage our market access to private flood to get yourself the best possible deal.

- You protect yourself from FEMA inconsistencies.

Ability to market large accounts on a quota share basis

-

- You can have multiple carriers participate in your risk.

- You can obtain a Segregated Captive Cell Insurance Company.

- Your options are maximized.

Policy comparisons

-

- You get to see how the policies stack up.

- You don’t get pressured.

- You gain the ability to make an informed decision.

Schedule of policies

-

- You get concise schedules detailing all your policies.

- You have clarity on what you have purchased.

Ability to receive contracts electronically or in a binder

-

- You get your policy documents the way you want to receive them.

- Your convenience remains our priority.

Honest advice

-

- You get your needs placed FIRST.

No-pressure sales environment

-

- You get to choose by determining if we can solve your queries.

- You don’t need to be worried about pushy salespeople.

Multiple proposals from one source

-

- You no longer need to shop multiple vendors.

- You get us to do it for you!